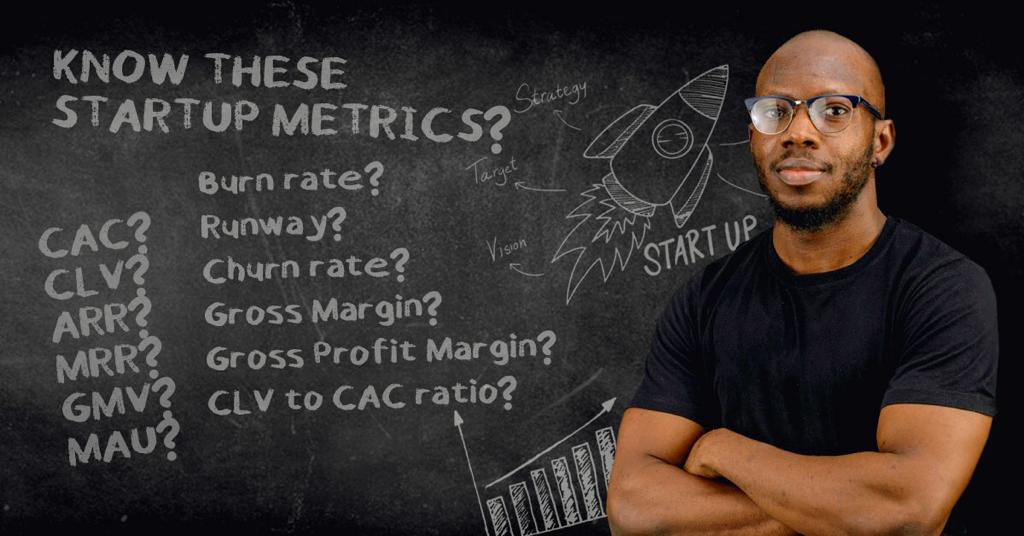

Nigerian startups raised $1.6 billion in 2021 from Venture Capitalists and more startups are looking to raise capital to scale their growth & expansion into new markets. Before venture capital firms signs that cheque to startups there is a lot of due diligence to be done. Venture capitalists analyse both quantitative metrics and qualitative methods to determine whether or not they are investing in a viable business. We will discuss the important quantitative metrics to get right before raising capital.

1) Monthly Recurring Revenue (MRR) & Annual Recurring Revenue (ARR): MRR is the expected revenue for your business based on your total subscriptions from customers. To calculate your MRR, multiply your total subscriptions by the average revenue per user (ARPU) e.g if you have 2,000 customers who have subscribed to your service at an average cost of $10 then your MRR is $4,000. To calculate the growth or decline in your MRR then you’ll have to factor in new subscriptions, upgrades, downgrades and cancellations/churn. Your Annual Recurring Revenue (ARR) is basically your MRR multiplied by 12.

2) Gross Merchandise Volume (GMV)

GMV is the total value of goods/merchandise sold and it’s mostly applicable to e-commerce businesses and is significant because revenue will come from the fees/commission charged on top of the GMV so if a company has $500,000 as monthly GMV, assuming they charge a commission of 4% on the GMV then they will have a revenue of $20,000.

3) Customer lifetime value (CLV)

CLV measures the average revenue generated over the duration of customer’s relationship with a company. For instance, based on a startup’s data, their customer spends $10 on a monthly subscription and stays with the company for 18 months, the startup’s CLV would be calculated as $10 multiplied by 18 months and then multiplied by the average number of transactions. For a business like Spotify with a monthly subscription model, CLV would be $10 X 1 X 18 months, equaling a CLV of $180.

VCs can get an estimate of the profitability of the startup’s customer and it’s business potential for long term growth based on it’s CLV.

4) Customer Acquisition Cost (CAC)

Customer Acquisition Cost is the average amount of money spent in obtaining a customer so it’s crucial to help investors see how efficient your customer acquisition is. Founders looking to raise capital need to look at their Fully loaded CAC : it involves the total cost of everything & everyone involved in acquiring new customers.

5) CLV to CAC Ratio

Your CLV to CAC Ratio helps you determine whether your CAC is high or low you in relation to your CLV and shows your investors how valuable your customer are to the company over their average lifetime. To calculate your CLV, to get it you divide your CLV by your CAC e.g If your CLV is $1,000 and your acquisition cost is $200 then your CLV to CAC ratio is 5:1

6) Churn Rate / Customer Retention rate

Investors want to how well your business is able to retain customers over time as an indicator that your product/service is delivering value to the customers. Customer retention rate basically helps a business understand how many of their customers they are able to retain over a certain period of time. Customer cohort analysis shows you a group of customers acquired in a given month and shows how the customers purchase over a period of time based on the initial month they signed up.

7) Gross Profit & Gross Profit Margin

Gross Profit is especially important for e-commerce business models and it help to show the profitability of a company to see if it is making a profit on each product sold and if your gross margin can cover for all the other expenses of running your company. It is typically calculated by subtracting the costs of goods sold (COGS) or services rendered to customers from the revenue. COGS does not include marketing expenses, staff costs, and other operating expenses.

Gross Profit Margin – is simply your gross profit represented as a percentage (%) of your revenue

8) Monthly Active Users (MAU)

Monthly active users is the total number of unique users who have performed some action on your website/app within the last month (30 days) e.g the number of people who buy a product, made a transaction e.t.c. A growing MAU base is a good sign of growth for the business and positive indicator investors would want to see.

9) Runway & Burn Rate

Cash Burn Rate is the rate at which a company depletes its available cash and that determines your operating runway, aka how long you can run the business. If your company has $10,000 cash and spends $1,000 per month but makes $500 in revenue per month then your net burn rate will be $500 per month while your gross burn rate is $1,000 per month hence giving you a runway of 20 months to be in business.

Before raising capital ensure these metrics are in order and your startup has a roadmap to optimizing them as you drive your company towards profitability.

-Written by Princewill Ejirika

Princewill Ejirika is an experienced Product Marketing & Growth Marketing manager in Africa who is passionate about building tech communities and helping startup/tech companies scale their growth.